How Does Excess Liability Work for LTL Shipments?

Understanding and calculating excess liability

As consumers, if an item we order is delivered damaged, or not at all, we’re accustomed to contacting the shipper to arrange a full refund or a free reshipment. The retail and e-commerce industries have largely standardized this process so consumers know what to expect. Many times, the replacement item will ship before the return is complete. So quick and easy!

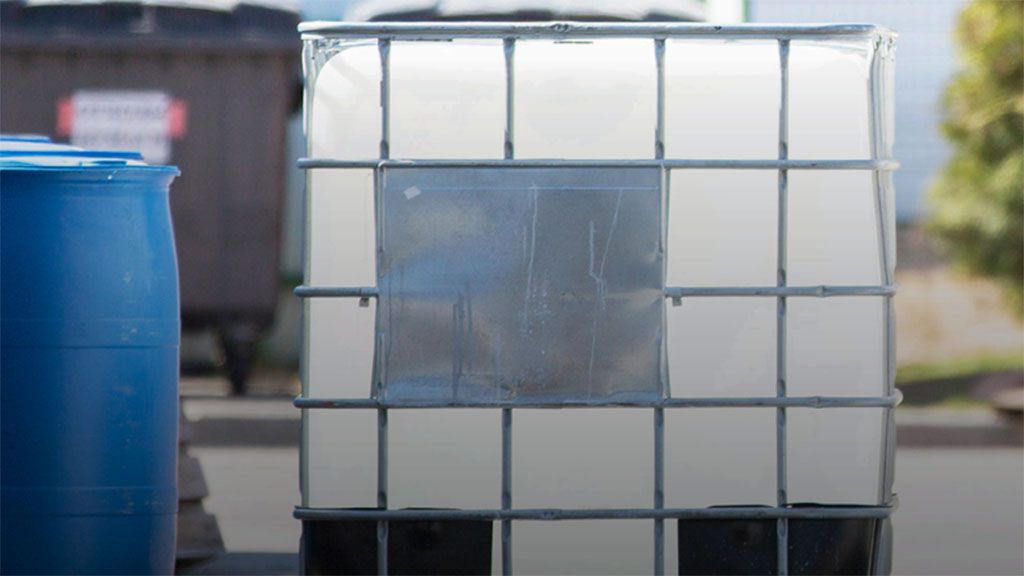

Now, let’s shift to the less-than-truckload (LTL) industry. This is an operations-based environment that moves freight throughout regional and national networks. The freight is loaded and often stacked in trailers, and may be handled multiple times at stops between the origin and destination. Excess handling, varying temperatures, imperfect road conditions and customer packaging disparities all increase the chance of an exception.

If you expect the reimbursement process for excess liability to be similar to the consumer process, you could be in for a surprise. It’s more complicated, and the terms can vary. To protect your LTL freight against loss or damage, make sure you fully understand your options for excess liability.

Essential Freight Transportation Guides and Tips

Trade Show Shipping: 10 Green Flags for Success

How to Ship to Mexico in 6 Steps

Common Mistakes: 4 Reasons for Delays at the Border

Freight Protection: Green Flags to Keep Your Cargo Safe

How to Calculate Your Freight Class?

Timely Tips: Product Launch Shipping Strategy

Exhibit with confidence: A Comprehensive Trade Show Shipping Guide

How do I know if I need excess liability?

If your shipment value is greater than the standard liability coverage, you may want to consider excess liability coverage.

You’ll need to calculate the standard cargo liability for the shipment. To do this, have the following information on hand:

- Total shipment value

- Shipment class

- Shipment weight

- Maximum liability amount (this can be found in the carrier’s tariff or your pricing agreement)

The standard cargo liability amount is calculated by multiplying the shipment weight by the maximum liability amount. In the example below, for a class 100 shipment, the maximum liability amount is $5.00 per pound. This results in a maximum total liability amount of $25,000 for a shipment valued at $40,000.

How much excess liability do I need?

Using the same shipment details above, calculate the amount of excess coverage needed by subtracting the maximum liability amount from the total shipment value.

How much will it cost?

Check with your carrier’s tariff or your pricing agreement for details. Most carriers will assess a percent upcharge based on the declared value in excess of the maximum liability amount. And, sometimes there’s a minimum charge. Be sure to read the complete terms.

In this example below, the carrier charge for excess coverage is 3%. The total charge is calculated by multiplying the excess coverage needed by the 3% upcharge for a cost of $450.

Is excess liability coverage the same as insurance?

No, they’re not the same. In the event of loss or damage, excess liability coverage can help fill the gap between standard liability and the declared shipment value. However:

- The burden of proof is on you, as the shipper, to show that the LTL carrier is liable for the loss or damage.

- A loss or damage claim must still go through the cargo claims process, which requires documentation, photo evidence and other supporting materials.

- Then, the LTL carrier will accept or deny the excess liability claim according to the cargo claims process and your pricing agreement. Be sure to check the terms and limits in your pricing agreement, as there may be exclusions.

If you calculate that your freight needs additional coverage, another option is to consider a more comprehensive cargo insurance policy from a third-party insurer.

Get the latest news and updates on XPO

Your choice of carrier matters

By choosing an LTL carrier that’s committed to providing exception-free service, you’ve taken a key step in securing your freight and limiting loss and damage. XPO has invested millions of dollars in its proprietary SafeStack system installed in its trailers. SafeStack braces freight against shifting during transit and prevents double-stacking. XPO’s use of air bags to fill gaps between pallets also helps to limit impacts during transit.

Learn more about XPO and the LTL solutions we offer to provide exception-free delivery.

Further Reading